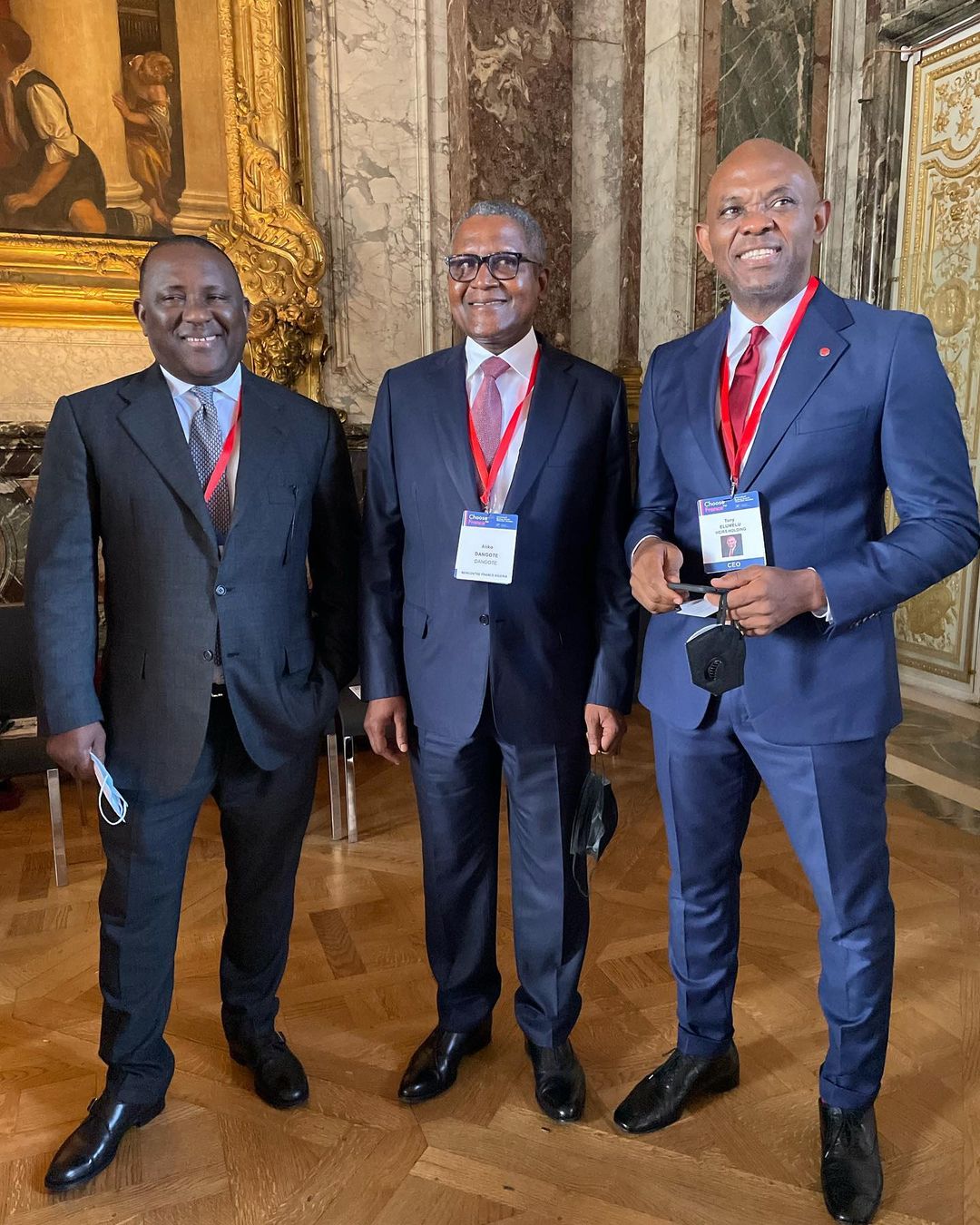

Tony O. Elumelu Speaks On Key Sectors of The Nigerian Economy

In a recent interview, our Founder shared his insights on key sectors of the economy. Here are some of our major takeaways:

ON INSURANCE:

“When phone use started, we had about 60,000 land phones but today approximately, 154 million Nigerians now have internet access, and it is only a matter of time for insurance to take its rightful space in our economy. It takes people like myself to show interest in the sector to revitalise the sector.

Insurance is critical in the wider financial intermediation space and Nigeria can use this to further national savings mobilization and economic activities. We make investments that create jobs and improve social welfare as Africapitalists .

When we tried to take over a distressed bank in 1997, it was very unpopular, but we were able to turn it around in record time. Subsequently, others have decided to take risks for themselves.

We bring this attitude to the insurance space – bringing what we know how to do, prioritising customers and using digital mediums to drive business, we think we can rekindle public interest in the insurance space.”

ON HOSPITALITY:

“As explained by the National Bureau of Statistics, for the first time in a while inflation is dropping. The GDP of Nigeria is now going up from being negative. Business sectors are slowly picking up, in our hospitality business, Transcorp Hotels, for example, occupancy was as low at 20% last year but has risen and is now between 60-80% on a daily which was rare even before the pandemic.

Once Leadership can deal with the challenges of security, things will continue to improve. The pandemic was bad but African leaders are beginning to have a grip on how to address macroeconomic policies that can have impact on their countries.”

ON POWER:

“We have an investment philosophy called Africapitalism that drives our business where we make long term investments in key sectors, we consider catalytic for economic growth. We realised it was important to look at the integrated energy play beyond just power. As we think of firewood and its impact on the environment, we want to move to more gas use. With the purchase of the OML 17, we believe that we can help bring access to energy products.

We want to make sure we have gas to support our power plants, the commissioning of our ultra-modern gas plants will happen in September or October this year. We believe gas is the next oil and we are happy that we have an asset producing gas daily.

We want to be able to produce 2000 megawatts of electricity daily. It will be a combination of feeding our power plant (AFAM Power plant) with gas and we believe that through our integrated oil and gas play we will improve access to electricity.”

TOE ON SMEs:

“As the Founder of the Tony Elumelu Foundation, the centre of our work is on prioritising and empowering young African entrepreneurs to realise their economic aspirations through training, networking, and support.

While access to capital is important, knowledge, discipline is crucial to the business. Through our digital platform, entrepreneurs are supported and have access to a virtual marketplace as AFCTA becomes more relevant.

When the macro environment is right, banks are more encouraged lend. One of the areas our country has done well is in agriculture, with farmers becoming more empowered through deliberate and consistent work of the Central Bank.

There is a need for the Private Sector and the Government to work together. One of the ways this can be done is through tax incentives. We also need to deal with why SMEs fail – and the heart of that is infrastructure – electricity, transportation, and adverse policy environment.”

TOE ON HOUSING:

“Economies that do not have a middle class cannot be strong economies. One of the basic human needs is shelter and it is an inspiration for many people to own a house. There are 2 critical issues; firstly, the titling law in Nigeria remains challenging. This is a low hanging fruit, where the right policies can change the sector drastically.

Additionally, the foreclosure law is also a challenge and things have not been properly done, the time it takes to access a mortgage has an impact on access to credit and the flow of credit.

The Mortgage to GDP ratio is also quite insignificant and needs to change. For everyone who leaves school and wants to buy a house, they should be able to do so. The banks are ready to do so but there are gaps in the policies.”

TOE ON MANUFACTURING:

“The manufacturing sector is one we are exploring actively and are hopeful for putting a foot in the door at the right time. We hope to set up an industrial pack, with power and gas from our centres where we will equip businesses with the right environment to run their businesses. With the AfCFTA presenting additional opportunities, we cannot ignore the opportunities present.”