Financial Times Echoes Tony O. Elumelu’s Views on Ensuring AfCTA Agreement is a Success

In an article titled “Nigeria Battles Conflicting Instincts on Africa Free Trade Zone”, Financial Times Journalist Neil Munshi quotes our Founder, Tony O. Elumelu’s views on the two things that must be addressed to ensure that the AfCTA agreement is successful.

According to Mr. Elumelu, “much of the deal’s success, and its potential for Nigeria, will come down to whether the continent can address its deficits in both infrastructure and finished products”

Read the full article below

Nigeria Battles Conflicting Instincts on Africa Free Trade Zone

Obstacles to agreement include rampant smuggling and inefficient customs processes

November 22, 2019, 4:00 am by Neil Munshi

In August, Nigeria partially shut its notoriously porous western border with Benin to try to stop the smuggling of foreign rice and encourage local production of the West African staple.

It went on to close all its land borders to the movement of goods. This was part of a broad set of actions instigated by President Muhammadu Buhari to restrict imports — both legal and illegal.

The steps taken by Nigeria serve to highlight the hurdles to intra-African trade that the country has to jump as it seeks to shape a deal that will create the world’s largest free-trade area in terms of member countries.

The obstacles include rampant smuggling, inefficient customs processes, a vast informal sector and the use of African countries as transit points for cheaper foreign goods. Until Mr. Buhari signed it this summer, Nigeria was the most prominent holdout to the African Continental Free Trade Area agreement (AfCFTA). As Africa’s biggest economy and most populous country, Nigeria is widely considered crucial to the success of a deal that will remove 90 percent of intra-African tariffs.

‘We are very excited about AfCFTA because we think this is an opportunity for a lot of African sellers to grow” Sacha Poignonnec

If, as its supporters hope, the accord is to boost economic growth on a continent with a gross domestic product of more than $3tn and a young, fast-growing population, the country that is home to roughly one in six Africans has to be on board.

Mr. Buhari, a staunch protectionist, spent more than a year deliberating before relenting, heeding calls from Nigeria’s powerful labour unions and industry groups to study the implications of the deal.

The repercussions could be far-reaching for an economy that holds great promise but is mired in sluggish growth with a manufacturing sector that is moribund. The more optimistic view is that if Nigeria gets its industry on track it can become the factory for the rest of the continent. This will allow it to export to the dozens of small, fragmented markets that make up Africa, and which currently largely import from the West or China. One of AfCFTA’s greatest attributes, supporters say, is the way it will create economies of scale for African and foreign businesses hoping to operate across the continent.

Sacha Poignonnec, chief executive of Jumia — the Pan-African e-commerce start-up known as the Amazon of Africa — says the “number one thing sellers tell me is they want help selling their products in more countries”. “We are very excited about [AfCFTA] because . . . we think this is an opportunity for a lot of African sellers to grow,” said Mr. Poignonnec, whose company generates about a quarter of its revenues in Nigeria, where it began operations. “We want . . . African sellers to increase their manufacturing, [so that more] products are created and manufactured in Africa.” There is a pessimistic view of the deal, however.

The Nigeria Labour Congress, an umbrella organisation for trade unions, was one of the biggest backers of Mr. Buhari’s cautious approach. In an August statement, it repeated its warning that instead of becoming manufacturing hubs, Nigeria — and other countries — could turn into “dumping grounds” for cheap Chinese and western goods.

That possibility has spooked manufacturing and labour groups. They worry that details of how the agreement will deal with local content, intellectual property rights and conflict resolution are far from resolved.

Implementation of any final agreement, which has been decades in the making, is at least a few years away, according to its architects. In the meantime, negotiators must contend with a history of regional trade agreements that have done little to bolster trade. There are at least eight such overlapping treaties in place.

The agreement is also aimed at boosting foreign direct investment, of which Nigeria is in desperate need. In 2018, FDI fell by 36 percent to $2.2bn compared with the previous year, according to UN data.

“We want to increase manufacturing so that more products are created and made in Africa” Sacha Poignonnec

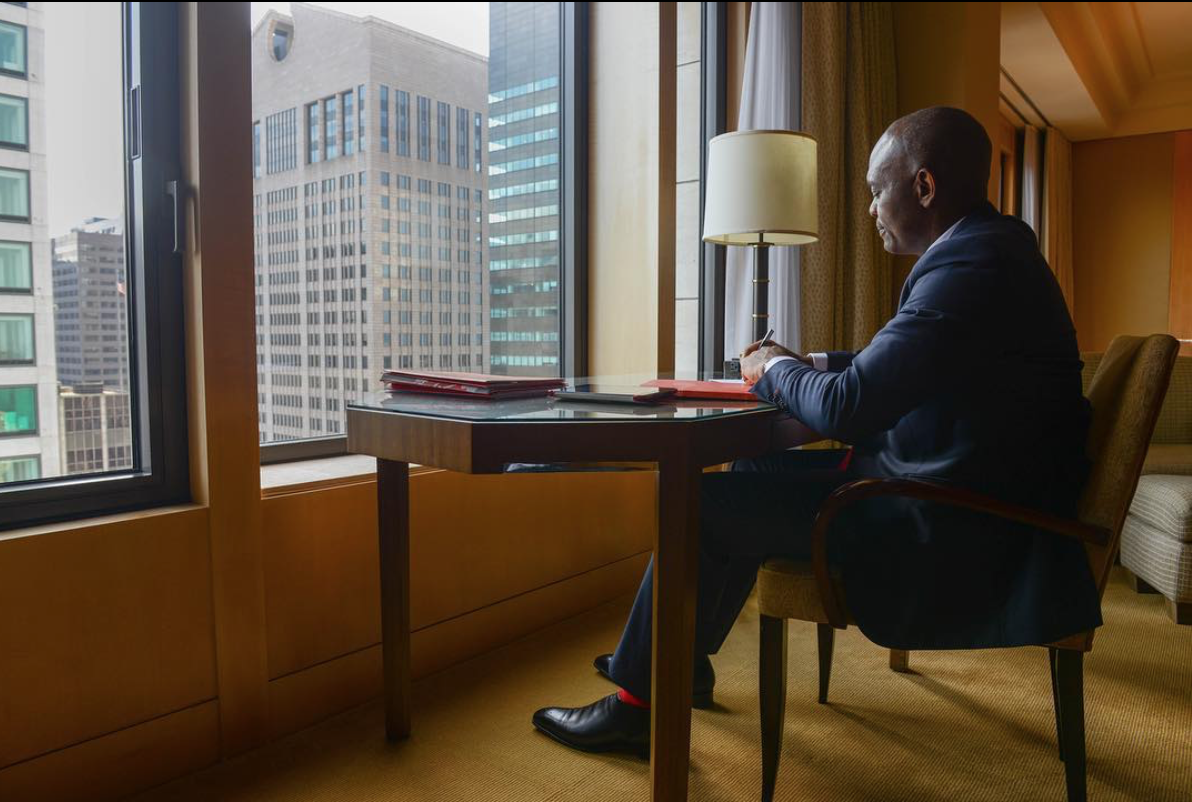

Much of the deal’s success, and its potential for Nigeria, will come down to whether the continent can address its deficits in both infrastructure and finished products, according to Tony Elumelu, one of Nigeria’s richest men, with interests in banking and oil and gas and chairman of the pan-African United Bank for Africa.

“If you look at Nigeria, we have rich crude oil endowment,” says Mr. Elumelu. “Imagine if we could refine the petroleum products, then, of course, the AfCFTA would make a lot of sense, because we could feed not only local consumption but we could leverage the AfCFTA to export across Africa.”

He questions, however, whether Nigeria has enough processed petroleum to meet its own needs, let alone those of the continent. “And even if we do, do we have the infrastructure to transport it across Africa?” he says. “I believe that as well-intentioned . . . [as the] AfCFTA is, these two things must be ensured for it to be successful.”

Source: Financial Times